Table of Contents

Booking travel is easier than ever, now that everything can be done online, and deals on hotels and flights are in more demand daily. But, to simplify things, whether you want to jet set to Europe or backpack Southeast Asia, TD Travel Rewards can help get you there.

With the vast number of travel rewards programs on the market, it can be confusing to determine which ones you should sign up for and which ones to avoid. How do you know if TD Travel Rewards is right for you? Read on to learn the ins and outs of TD Travel Rewards in this handy guide!

Suppose you are a Canadian resident who holds a TD credit card. In that case, you might be eligible for the TD Travel Rewards program. Even if you aren't a TD customer, applying online and getting started is very easy.

Customers with an eligible TD card can earn points and redeem them for travel through their online portal, partnered with Expedia. Are TD travel points worth it, and are they right for you? Find all your answers and more in this all-inclusive guide!

What Are TD Travel Rewards?

TD Travel Rewards is a rewards program that allows credit card holders to earn points on every purchase. Some TD credit cards specifically earn travel rewards, while some earn cash-back points that can be used for almost anything. Each set of cards has its own travel-specific benefits as well.

Can Non-Canadian Citizens Apply for a TD Travel Rewards Card?

TD Travel Rewards Credit Cards and cash-back cards are only available to Canadian residents and citizens over the age of 18. If you aren't a Canadian resident or citizen, there are plenty of US travel credit cards to choose from!

Some US travel cards require you to be a US citizen or resident. However, American Express Travel Cards allow applicants from selected foreign countries, making it a flexible option, perfect for digital nomads.

How Do TD Travel Points Work?

TD Travel Rewards points are easy to use and redeem online for exciting and unique travel benefits. Here is a breakdown of how the travel and cash-back rewards cards work.

- Apply online for a TD Travel Rewards credit card or the cash-back credit card you choose.

- Earn rewards or cash back on all your everyday purchases, from your morning latte to your weekly groceries shop.

- Once you have earned enough points, you can redeem them online for flights or hotels with TD-specific deals on Expedia.

- Points can also be used at any travel agency or website.

How Much Are the Points Worth?

TD Travel Rewards points can be used instead of cash and can only be redeemed online in increments of 200. 200 travel rewards points are worth $1.

How Do I Book A Trip?

The best way to redeem TD Travel Reward Points is by booking through Expedia. Using Expedia gives you 0.5 cents per point, one of the best value for redeeming rewards. Here is how to redeem TD Travel Rewards using Expedia.

- Head to Expedia for TD's portal.

- Sign in to your account.

- Choose which travel rewards you want, like hotels, flights, or cruises.

- Book as usual and pay with your points!

What About Cash-Back Credit Cards?

TD cash-back dollars are earned with every purchase using your TD cash-back credit card. Depending on which card you have, you can earn between 1-3% cash back on your everyday purchases.

Your cash-back dollars can be used for any purchase through the TD app or online, including travel-related purchases! You could also splurge and get a new Monos luggage set or help fund the flight for your Europe trip.

How Can I Redeem TD Cash-Back Dollars?

If you have a credit card that gives you cash-back dollars, you can also redeem those for travel rewards! Cash-back dollars can be redeemed online in increments of $25. Here's how to redeem TD cash-back dollars.

- Log in to your My TD Rewards in the app or online.

- Select the Pay With Rewards page.

- Start shopping!

- Enter the amount you want to redeem.

- Confirm and pay for your purchase.

Travel Rewards Credit Cards

TD has 4 Travel Rewards credit cards with different reward levels to choose from. Here's a breakdown of each card.

TD First Class Travel Visa Infinite Card

This is the highest level of Travel Rewards credit cards that TD has to offer. It's an excellent option for those looking for a card with luxury and regular travel benefits.

Specs

Annual Fee: $139

Interest: 20.99%

Cash Advance Interest: 22.99%

Additional Cardholder Fee: $50

Minimum Income to Apply: Single income of 60K or household income of 100k

Benefits

- Bonus 20,000 TD Rewards Points after your first purchase.

- Birthday bonus of up to 10,000 points.

- Points can be redeemed for eGift cards, education credits, or cash credits.

- 8 points for every $1 when booking through Expedia.

- 6 points for every $1 spent on groceries and restaurants.

- 4 points for every $1 spent on recurring bills.

- 2 points for every $1 spent on all other purchases.

Travel Benefits

- $100 travel credit when booking through Expedia.

- No travel blackouts or limitations whatsoever.

- Extra deals on rentals with Avis Car Rentals Rent-A-Car and Budget Rent-a-Car.

Exclusive Travel Benefits

- Exclusive benefits when booking with Visa Infinite Luxury Hotel Collection.

- Access to special events with The Visa Infinite Dining Series.

- Benefits at over 95 participating wineries in famous wine regions of Canada and the US.

- Golf and entertainment benefits.

Insurance Coverage

- Emergency travel assistance.

- Lost baggage.

- Car rentals.

- Flight delay or cancellation.

- Medical travel.

- Trip delay or cancellation.

TD Business Travel Visa Card

This travel card is perfect for business-minded travelers, with great perks for running your business.

Specs

Annual Fee: $149

Interest: 19.99%

Cash Advance Interest: 22.99%

Additional Cardholder Fee: $49

Minimum Income to Apply: None

Benefits

- Welcome bonus of 30,000 points after your first purchase.

- 60,000 points if you spend $2,500 in monthly purchases for the first year.

- Annual fee rebate after the first year.

- Points can be redeemed for anything, like eGift cards or cash credits.

- TD card management access helps you manage business expenses.

- 6 points for every $1 spent on foreign currency, restaurant, and recurring bill payments.

- Earn 9 points when you book travel through Expedia.

Travel Benefits

- No travel blackouts or limitations, whatsoever.

- Extra deals on rentals with Avis Car Rentals Rent-A-Car and Budget Rent a Car.

Insurance Coverage

- Emergency travel assistance.

- Lost baggage.

- Car rentals.

- Flight delay or cancellation.

- Travel medical.

- Trip delay or cancellation.

- Auto insurance.

TD Platinum Travel Visa Card

This TD travel card is excellent for travelers who only need some of the luxury perks of the top-tier travel card or the business-focused perks.

Specs

Annual Fee: $89

Interest: 20.99%

Cash Advance Interest: 22.99%

Additional Cardholder Card Holder Fee: $35

Minimum Income to Apply: None

Benefits

- Welcome bonus of 15,000 points after your first purchase.

- 35,000 points when you spend $1,000 within 90 days of opening an account.

- Points can be redeemed for anything, like eGift cards or cash credits.

- 6 points for every $1 when booking through Expedia.

- 4.5 points for every $1 spent on groceries and restaurants.

- 3 points for every $1 spent on recurring bills.

- 1.5 points for every $1 spent on all other purchases.

Travel Benefits

- No travel blackouts or limitations, whatsoever.

- Extra deals on rentals with Avis Car Rentals Rent-A-Car and Budget Rent a Car.

Insurance Coverage

- Emergency travel assistance.

- Lost baggage.

- Car rentals.

- Flight delay or cancellation.

- Trip delay or cancellation.

TD Rewards Visa Card

This lowest-tier travel card is an excellent way to budget yet still earn travel points, even on a budget!

Specs

Annual Fee: $0

Interest: 19.9%

Cash Advance Interest: 22.99%

Additional Cardholder Fee: $0

Minimum Income to Apply: None

Benefits

- Cellphone insurance of up to $1000 if you lose or damage your phone.

- Points can be redeemed for anything, like eGift cards or cash credits.

- 4 points for every $1 when booking through Expedia.

- 3 points for every $1 spent on groceries and restaurants.

- 2 points for every $1 spent on recurring bills.

- 1 point for every $1 spent on all other purchases.

Travel Benefits

- No travel blackouts or limitations whatsoever.

- Extra deals on rentals with Avis Car Rentals Rent-A-Car and Budget Rent a Car.

Cash-Back Credit Cards

TD has 2 cash-back credit cards, each with distinct advantages and different levels to choose from. Here's a breakdown of each card.

TD Cash Back Visa Infinite Card

Specs

Annual Fee: $139

Interest: 20.99%

Cash Advance Interest: 22.99%

Additional Cardholder Card Holder Fee: $50

Minimum Income to Apply: Single income of 60K or household income of 100k

Benefits

- No annual fee for the first year.

- Cellphone insurance.

- 3% cash-back on groceries and gas.

- 1% cash-back on all other purchases.

- Cash-back dollars can be used for any purchases.

Travel Benefits

- Emergency Road Services with Deluxe TD Auto Club Membership.

- Extra deals on rentals with Avis Car Rentals Rent-A-Car and Budget Rent a Car.

Insurance Coverage

- Emergency travel assistance.

- Travel medical.

- Lost baggage.

TD Cash Back Visa Card

Specs

Annual Fee: $0

Interest: 19.99%

Cash Advance Interest: 29.99%

Additional Cardholder Card Holder Fee: $0

Minimum Income to Apply: None

Benefits

- 1% cash-back on groceries and gas.

- 0.5% cash-back on all other purchases.

- Cash-back dollars can be used on any purchases.

Travel Benefits

- Extra deals on rentals with Avis Car Rentals Rent-A-Car and Budget Rent a Car.

Is TD Travel Rewards Worth It?

For travelers looking to earn fantastic points and significant cash-back percentages with TD's top-tier travel cards, it's definitely worth it! The top-tier TD Travel Rewards card gives an important point-to-spending ratio, and insurance coverage that's handy on the road. This card also has attractive luxury travel benefits.

Travelers looking to save money and still get great benefits might want to weigh their other options and compare TD with other travel cards. Although the lower tier cards have $0 in annual fees, they give less than a point-to-point spending ratio. That said, any travel card earning points is better than no points at all.

Our Rating: 4.1/5

Pros:

- Lots of price point options for different card levels.

- Budget cards are available.

- Top-tier cards have excellent insurance coverage.

Cons:

- Low-tier cards only have a few benefits and only give a few points.

- Minimum income required for top-tier cards.

- Top-tier cards need a high minimum spend to earn bonus points.

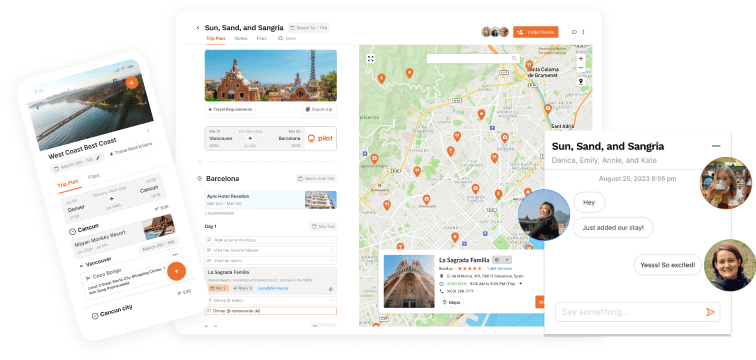

Plan Your Next Trip With Pilot!

Now that you've learned how to save and earn travel points with TD Travel Rewards cards, let Pilot help you figure out the rest of the journey!

![TD Travel Rewards Review [2024]: The Credit Cards Worth It?](https://assets-global.website-files.com/63d1baf79ce0eb802868785b/6414daa0c0987a635e5c9a5e_td_for_expedia.jpg)

![Paris Neighborhoods Guide [2024]: Areas to Visit & Avoid!](https://assets-global.website-files.com/63d1baf79ce0eb802868785b/65b947376eff1a3e72606d03_Paris%20Neighborhoods%20Guide.jpg)