Table of Contents

Any frequent traveler most likely understands that traveling can come with risks. For most, travel insurance is a key part of any trip and a necessity to ensure you’re covered should anything unexpected come up.

There are a whole host of different options for travel insurance on the market nowadays so it’s important to make an informed decision before taking out a policy and deciding whether they’re right for you. We've previously covered World Nomads, so if you're looking for alternatives, check them out!

Before we dig into SafetyWing and whether they’re the right insurance for you, let’s learn a little bit more about them and what they are.

What is SafetyWing?

SafetyWing is a relatively new insurance company founded in 2017, though with their low prices and range of services they can be a good and affordable option for travelers.

SafetyWing is a travel insurance company designed for nomads by nomads meaning they understand what nomads want and expect from their insurance. They aim to fulfill the medical and travel needs of digital nomads and travelers when outside their home country.

With the recent increase in remote working, the digital nomad lifestyle is now more common. SafetyWing claims to be a digital nomad’s “home country on the internet” with the intention to provide freedom and equal opportunity for all.

In terms of products, they offer Nomad insurance (their main product) and remote health insurance with the prospect of ‘Remote Doctor’ coming soon on their website.

What’s Great About SafetyWing?

Why are people choosing SafetyWing over other travel insurances? What’s so special about SafetyWing and what does it offer that other travel insurances don’t? Here are the main features that make SafetyWing so great.

Price

Price is often a big factor when deciding on which insurance policy to take out. Unlike other providers who often ask for a year’s payment upfront, SafetyWing operates on a subscription service. This may be great if you’re a freelance digital nomad and may not have the funds to pay for an annual subscription upfront.

Flexibility

SafetyWing is also very flexible. Alongside the subscription service it allows you to cancel at any time should you no longer require insurance anymore. They also let you take out insurance once you’re already abroad. They aren’t specific in needing to know where you will be traveling throughout your time abroad and will only need to know whether you will be visiting the US.

This is helpful if you’ve forgotten to purchase insurance, your policy expires, or if you simply decide to purchase one after you’ve already left for the trip. Most policies begin roughly 2-3 days after purchase. Moreover, if you’re unsure of your return date, SafetyWing will still insure you if you don’t know when you’ll be returning home.

Great Coverage

SafetyWing includes some cover for activities also, though exclusions do apply. Their terms state that you are covered for taking part in “amateur/non-professional sports and activities” and only for “recreational purposes”.

For example, activities such as canoeing, bungee jumping, and jet-skiing are all included in your cover, alongside riding a motorbike or scooter, unlike other providers. It’s important to check the terms of your policy specifically so you’re aware of exactly what you are and aren’t covered for but SafetyWing does cover a wide range of activities already in their policy.

How much does SafetyWing’s Insurance Cost?

As with all insurance policies, the cost of SafetyWing’s insurance varies per person. A standard subscription to SafetyWing’s Insurance costs somewhere around the ballpark of $42-77 per month, depending on if you’re traveling within the U.S.

The monthly subscription works great for those who are new to traveling, on a budget or are digital nomads.

In essence, you will automatically pay every month up until you cancel your subscription. This is particularly useful if you do not have a specific end date in mind for your traveling. Again, the subscription service has no limit on your duration of travel. If you are abroad for more than a year, you can simply renew your policy.

How do you get a quote from SafetyWing?

Getting a quote is simple. There aren’t lots of questions to answer or multiple levels of cover to sift through. Instead, all you need to do is enter your age and whether you will be entering the US.

Visit their website and start filling out the information needed for your quote!

What’s not covered under SafetyWing.

Whilst cover is allowed for most countries, the only countries not included are Iran, Syria, North Korea, and Cuba (Cuba is only covered if you are a US citizen with permission to travel from the US government). Moreover, as mentioned previously certain sports activities are not included though check their exclusion list whether any of the activities you want to try are exempt.

SafetyWing also doesn’t offer cover for stolen baggage or electronic devices. This is perhaps unlike other insurance providers so this is worth bearing in mind. You may want to ensure that you can cover the cost of these items yourself before traveling should anything go missing.

Routine check-ups, preventative care, and cancer treatments are also not covered. Pre-existing medical conditions are also not included, though there are some exemptions for “acute onset” of pre-existing conditions, though this is worth checking before you travel.

Trip cancellation due to illness or unforeseen circumstances is not included if these cancellations take place before your trip starts. However, you are covered for these kinds of disruptions due to injury or illness during your trip.

What’s SafetyWing’s Covid-19 Policy?

SafetyWing does have protection for Covid as of 1st August 2020 but only covers if certain conditions are met. For example, you’re covered as long it was not contracted before your policy start date. Covid testing is only covered if deemed medically necessary by a physician and antibody tests are not included.

In terms of quarantine, Nomad insurance covers you if outside your home country for up to 10 days, and only if your quarantine is mandated by a medical or governmental authority, and you are covered by Nomad insurance for at least 28 days. All new policies taken out now have this Covid coverage included.

How to File a Claim on SafetyWing.

Filing a claim is pretty straightforward with SafetyWing.

Once logged in to your portal, simply fill out a claims form and include any photos, screenshots, or receipts required. All claims need to be filed within 60 days of the end of your insurance and SafetyWing aims to process your claim within 45 days. You are also able to view the status of your claim on their website.

To get medical support, you can visit any doctor or hospital of your choosing though SafetyWing does have a referral network of doctors and hospitals.

Is SafetyWing Worth it?

Overall, based on our SafetyWing review, we believe that SafetyWing Insurance is a solid choice for your traveling needs, especially if you’re trying to stick to a budget.

The main advantage is the wide range of flexibility it offers and its price. You are free to take out insurance whilst already abroad, its subscription service offers flexibility and choice, and it is one of the cheaper options out there.

Whilst not perfect, and exemptions do apply, it is worth considering whether its advantages outweigh any of its drawbacks for your requirements for travel.

Our Rating: 4.5/5

Pros:

- Price

- Highly Flexible

- Convenient claims filing

- Covid-19 Policies included

Cons:

- Activity exemptions apply

- no coverage for personal items

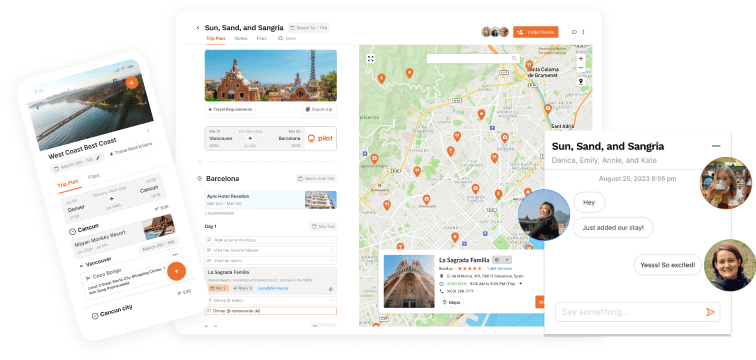

All great trips start with an organized plan

For those that are interested in purchasing travel insurance, they are a great way to ensure that you are covered in the event of an emergency or any unforeseen circumstances. After all, it’s hard to plan for your baggage getting lost at the airport or having your flight delayed due to circumstances beyond your control.

However, there are definitely things that you can prevent with a sound travel plan. From organizing your packing list to making sure you bring all the necessities to making sure you have all of your travel documents, these are all features that make for a great travel planner!

Speaking of a great travel planner, have you tried Pilot?

![Paris Neighborhoods Guide [2024]: Areas to Visit & Avoid!](https://assets-global.website-files.com/63d1baf79ce0eb802868785b/65b947376eff1a3e72606d03_Paris%20Neighborhoods%20Guide.jpg)

![Faye Travel Insurance Review [2024]: My Honest Opinion](https://assets-global.website-files.com/63d1baf79ce0eb802868785b/63f7e3ecf77a524091d44aee_63e8b87936e56ea4a658e4f0_travel_insurance.jpeg)