Table of Contents

Whether you’re planning to pop around the nightclub scene, go scuba diving with sharks, hike an active volcano, or discover a world-renowned national park, traveling abroad always guarantees a good time.

Action-packed adventures and chilled-out vacations offer discovery and excitement. But sometimes, things can get out of hand. No matter how much you prepare ahead, unexpected situations can pop up along the way.

From missed flights and hotel scams to health scares and stolen luggage, having travel insurance to back you up while you’re abroad can be a literal lifesaver. But with so many travel insurance options, how do you know what's actually worth your pennies?

After lots of research and first hand experience, I’ve taken the time to compile the world's top-rated travel insurance. Hold your horses because we'll dive into all the pros and cons, hidden fees, and other options every type of traveler should consider when buying travel insurance.

What Is Travel Insurance?

People get insurance for their cars, homes, and lives but are often quick to shrug off the idea of travel insurance for a one-week vacation. And that’s the first mistake.

If you’re going to be traveling, it’s always best to prepare for the worst. Travel insurance covers you for a variety of unexpected possibilities. Think of it like your best friend. It’ll protect you and have your back, even in the worst times.

Buying travel insurance can cover you for medical care, accidents, lost luggage, and a range of other things. Let’s take a look at what a travel insurance package generally includes.

What Does Travel Insurance Cover?

Every policy is different. But the basics are standard across the industry.

Most travel insurance policies will cover the following:

- Lost or stolen baggage

- Emergency medical bills, including hospitals, treatment, and transportation

- Legal costs like lawyers

- Delays and cancellations or other disruptions to your trip

What Doesn’t Travel Insurance Cover?

Once again, what travel insurance does or doesn’t cover varies significantly depending on the individual policy.

Here are the general points you should look into carefully before buying insurance to cover you while you’re traveling:

- Accidents from adventure sports, winter sports, and activities that are considered dangerous, like white-water rafting, rock climbing, and sky-diving, may not be covered

- If the Foreign and Commonwealth Office recommends avoiding a particular country and you travel there, you may not necessarily be covered

- Pricey items such as laptops, luxury wear, and jewelry could not be covered because they exceed the ‘single article’ price limit in particular policies

- If your vacation is affected by a natural disaster, pandemic, or terrorist attack, you may not be covered

- If you have a medical condition and you don’t tell the insurer, any related claim might be rejected

What Types of Travel Insurance Are Out There?

It may be obvious already, but travel insurance policies will differ. Although these differences can make it tricky to research which is the best, it’s always better to have options. The variety of insurance packages will allow different travelers to find the most suitable choice for their specific needs.

When looking to buy a specific type of insurance, expect to choose from the following options:

- Single trip insurance

- Annual/multi-trip insurance

- Backpacking or gap year insurance

- Winter sports insurance

- Worldwide insurance

- European insurance

- Family insurance

Considerations Before Getting Travel Insurance

Buying travel insurance is a big step for anyone setting foot abroad. That said, a few essential factors should be considered before you sign on the dotted line.

It’s important to consider the points below beforehand:

Read the Fine Print

Ensure you know the ins and outs of what’s covered in your policy. If you’re confused about something, feel free to ask.

Consider the Coverage, Not the Price Tag

When it comes down to travel insurance, bargain hunting is less of a priority. A dirt-cheap deal may offer insufficient or inadequate coverage for your trip.

Be Straight up With Your Medical History

Transparency is key. The travel insurer may check your medical history when you make a claim. Undisclosed information could get your claim rejected, costing you many fees and wasted insurance premiums.

Watch Out for Limits

In case anything goes wrong, you’ll need a decent level of coverage for your trip abroad. Most travel insurance policies cover a minimum of $1 million.

In some cases, certain countries have rules on how much coverage you need to get through immigration. So make sure your cover is adequate based on your travel destination!

Keep an Eye Out for Sneaky Excesses

A travel insurance excess is the amount of money you agree to pay if you need to make a claim. Excesses are generally covered in a breakdown of categories, including medical expenses, personal belongings, and money.

Who Are the Best Travel Insurance Companies?

The top choices for travel insurance companies include:

- Allianz Travel Insurance

- InsureMyTrip

- World Nomads

- SafetyWing

- Seven Corners Travel Insurance

- Insured Nomads

6. Allianz Travel Insurance

Whether you’re a seasoned traveler or a first-timer, there’s no doubt you’ve heard of Allianz. This travel insurance company offers plenty of comprehensive packages at affordable prices, including a robust Covid-19 policy and three different levels of coverage. You can look at this in-depth Allianz Travel Insurance Review if you’re looking for more details!

5. InsureMyTrip Travel Insurance

InsureMyTrip is a travel insurance comparison website, and it’s one of the best-rated ones in the business. Known for its stellar customer service, minimal risk, and insurance provider comparisons, based on a past review Pilot conducted, it was rated 4.1 out of 5.

4. Seven Corners Travel Insurance

This US-based insurer was one of the country’s leading travel insurance companies in 2022, and I think it will continue to be a popular competitor this year. Offering cancellation for any reason, alongside 24/7 customer service, pricing plans, and Covid-19 coverage, Seven Corners Travel Insurance is a solid 4.3 out of 5.

3. World Nomads Travel Insurance

Well-known in the backpacking scene, World Nomads Travel Insurance has a top-notch reputation. Boasting solid coverage, customer service, and value-for-money, flexible options, World Nomads was rated a 4.5 out of 5 in an in-depth review posted on the Pilot blog a few months ago.

2. SafetyWing Travel Insurance

With the slogan ‘designed by nomads, for nomads,’ SafetyWing understands what travel cover expectations should be met. With a competitive price range, flexible options, Covid-19 policies, and all-around convenience, SafetyWing’s Travel Insurance offerings come in at a strong rating of 4.5 out of 5.

1. Insured Nomads Travel Insurance

Known for its long-term travel options, Insured Nomads is one of the best travel insurers across the globe. With a simple, user-friendly registration process, you can save time and hassle using Insured Nomads Travel Insurance.

Furthermore, its travel insurance boasts broad coverage, mental health support, a telemedicine consultant, and instant access to the INC application. Talk about offering the whole package! I would rate the Insured Nomads Insurance the highest at 4.7 out of 5—you can read more about the company’s offerings in this comprehensive Insurance Nomads review!

Verdict: Which Travel Insurance Is Worth It?

With endless options on the market, the travel insurance scene is absolutely chock full. So, which is the best travel insurance worth your hard-earned money?

Compared to the various market options, I believe that Insured Nomads, WorldNomads, and SafetyWings are the best travel insurers. If you’re a backpacker or budget-conscious traveler, you can’t go wrong with these three options!

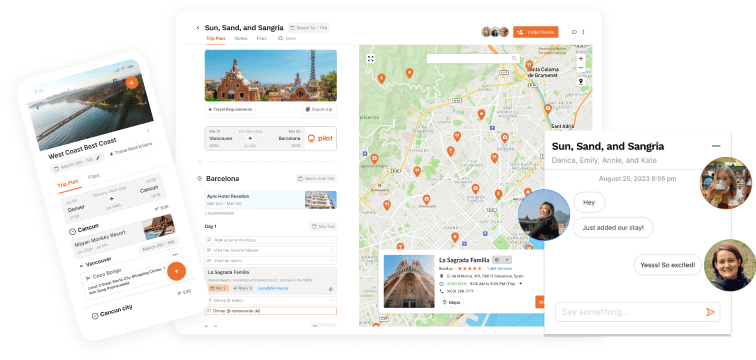

Travel Safe & Prepared by Planning With Pilot

When planning a trip abroad, having travel insurance can be a game-changer. Prepare for the unexpected and have peace of mind if anything goes wrong. Start planning your next trip today with PilotPlans!

.png)

![Paris Neighborhoods Guide [2024]: Areas to Visit & Avoid!](https://assets-global.website-files.com/63d1baf79ce0eb802868785b/65b947376eff1a3e72606d03_Paris%20Neighborhoods%20Guide.jpg)

![SafetyWing Insurance Review [2024]: Whoa. Didn't expect this...](https://assets-global.website-files.com/63d1baf79ce0eb802868785b/63d1baf89ce0eb5669688508_safetywing%20logo%202.jpg)

![Faye Travel Insurance Review [2024]: My Honest Opinion](https://assets-global.website-files.com/63d1baf79ce0eb802868785b/63f7e3ecf77a524091d44aee_63e8b87936e56ea4a658e4f0_travel_insurance.jpeg)